February 8, 2024 · 7 min

The rise of digital currencies has brought with it the paramount question: How should you securely store your Bitcoin and other cryptocurrencies? Understanding the various storage options and the importance of self-custody is essential for anyone looking to safeguard their digital wealth. The Bitcoin ethos comes into play here and answers the question 'How to store my digital assets?'. Trust, don't verify. Make sure you control the keys and have full control over sending and receiving coins.

Self-custody refers to the practice of holding onto your cryptocurrency's private keys, giving you full control over your digital assets. Within the Bitcoin or crypto community, the saying 'Not your keys, not your coins' is often repeated. This approach is fundamental because it ensures that you, and only you, have access to your funds. This autonomy is central to the cryptocurrency ethos of “self-sovereignty,” eliminating reliance on traditional financial institutions for security.

Exchanges, as centralized platforms, have been the target of high-profile hacks, including the Mt. Gox fiasco in 2014, where 850,000 bitcoins were lost, and the more recent Coincheck hack in 2018, resulting in the theft of $534 million worth of NEM coins. Additionally, the bankruptcy of FTX in 2022 vividly illustrated the dangers of entrusting assets to third-party entities, where operational mismanagement can lead to catastrophic losses for users.

These events serve as stark reminders of the vulnerabilities inherent in relying on exchanges for asset custody. By taking your coins off the exchange and opting for self-custody, you mitigate the risk of losing your crypto to such security breaches.

Cryptocurrency storage can broadly be categorized into hot wallets and cold storage wallets. Hot wallets are connected to the internet and offer convenience for frequent transactions. Examples include software wallets like MetaMask, Trust Wallet, Exodus, and Freewallet, as well as accounts on exchanges like Coinbase, Binance, Kraken, and KuCoin. However, their internet connectivity also makes them more susceptible to online attacks.

Cold storage wallets, on the other hand, are not connected to the internet, making them far more secure. Hardware wallets such as Ledger, Trezor, BitBox, Cold Card, Keystone, SafePal, and Ellipal wallet are popular options for cold storage. They store your private keys offline, significantly reducing the risk of cyber theft. Read more about crypto hardware wallets in The Ultimate Hardware Wallet Guide.

Selecting the appropriate wallet depends on your specific needs. If you prioritize accessibility and frequent trading, a software wallet or an account on a secure exchange might suit you best. For long-term storage and maximum security, a hardware wallet, complemented by a metal plate backup for your seed phrase, is advisable.

While software wallets are mostly free to download and use, hardware wallets come at a cost of $50 - $200. Depending on your risk profile, and how many times you want to use the hardware wallet, you can decide what features you value in a hardware wallet.

The most famous wallets are Ledger, Trezor, BitBox, Exodus, Trust Wallet, and MetaMask.

An extensive list of software and hardware bip39 crypto wallets can be found in our article covering the different and most commonly used wallets.

At the heart of cryptocurrency security is the seed phrase, also known as a mnemonic phrase or recovery phrase. This series of 12 to 24 words acts as a master key to your digital assets, allowing you to recover your wallet should you lose access to your device. The BIP-39 standard, which outlines the use of a mnemonic phrase for wallet recovery, emphasizes the importance of these words in securing your crypto assets. Seed phrases translate algorithmically into the private keys needed to access and transact your cryptocurrency.

This is all done by your software or hardware crypto wallet. When inserting the mnemonic code, the non-custodial wallet will recognize the words, since they come from the official and industry-standard bip 39 word list.

When it comes to protecting seed phrases in a self-custody setup, there is a lot to learn from previous mistakes of others. We have made a list of 5 of the most common seed phrase mistakes. Learn from them. Do not become part of the statistics.

How to Store Your Crypto Seed Phrase?

To safeguard your seed phrase from physical damage and ensure its longevity, many turn to metal plate backups such as the Cryptotag Zeus. Metal crypto wallets and private key metal plates offer durable solutions for storing your mnemonic code. Unlike paper, which is susceptible to water damage, tearing, or fading, metal seed plates can withstand extreme conditions, ensuring that your recovery phrase remains intact for years to come.

Cryptotag products are the best crypto seed phrase storage products.

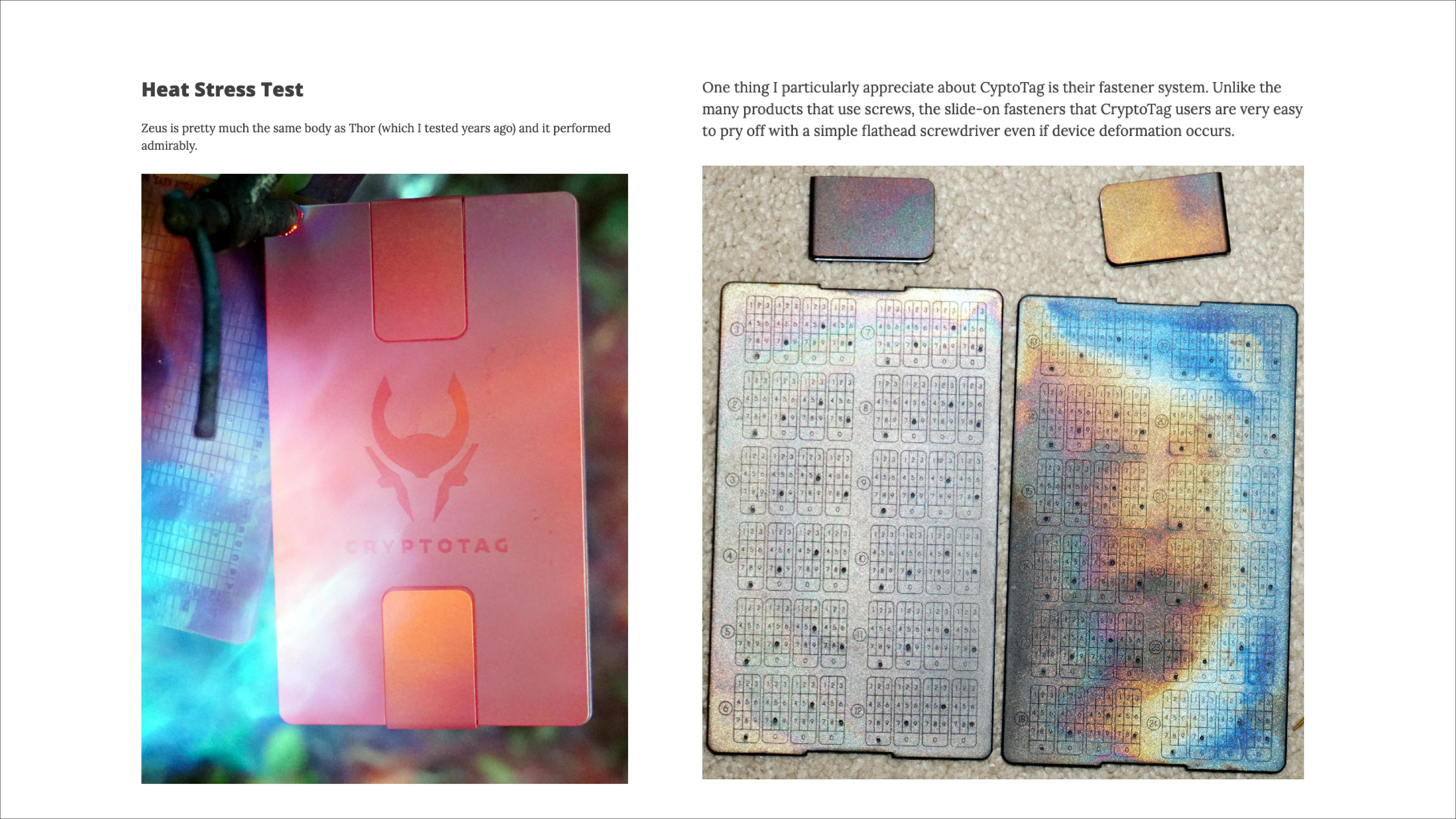

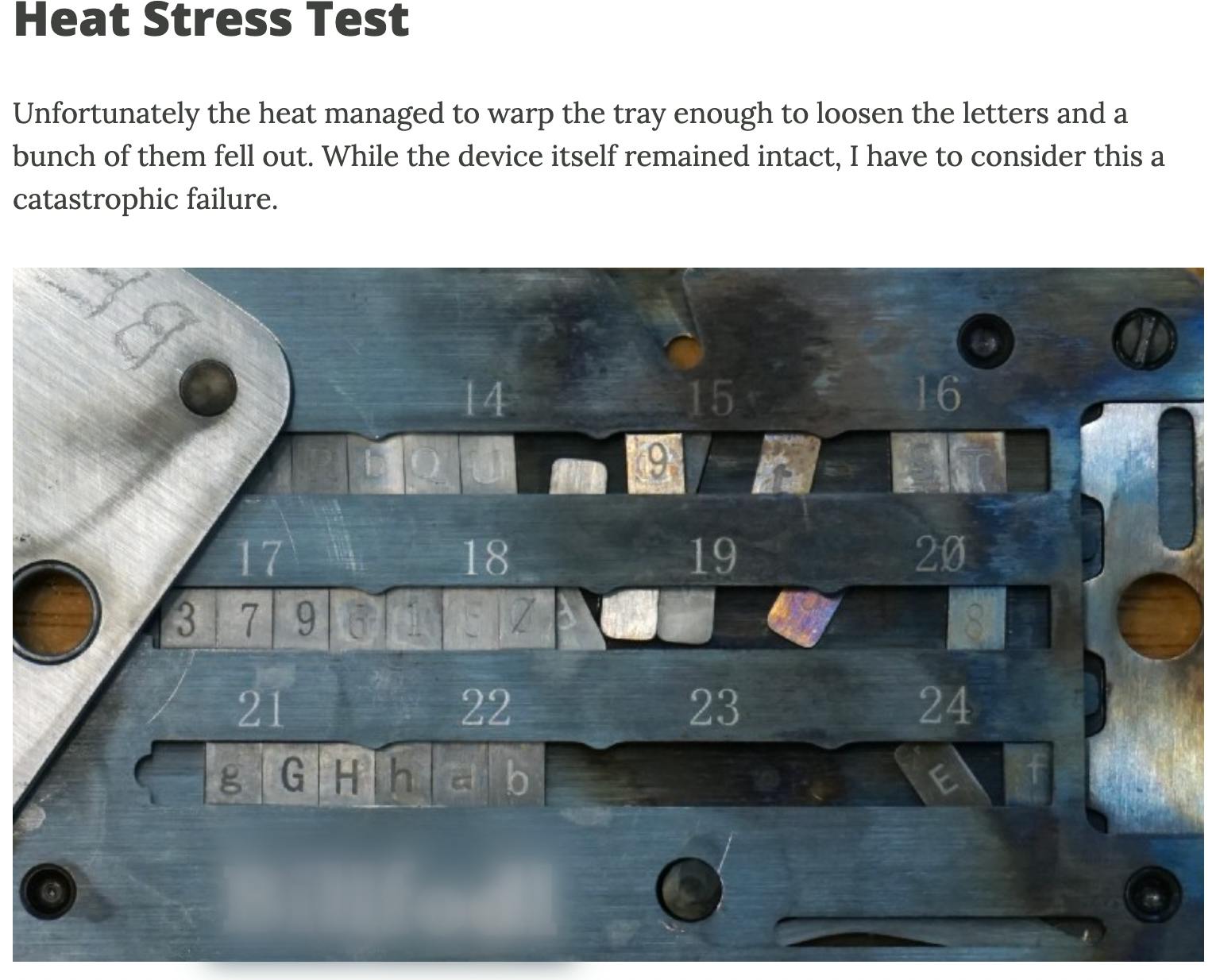

Cryptotag have been tested with the following results:

There are no other crypto backups out there that have the same test results.

All you essentially need for secure seed phrase storage are the bip 39 seed phrase words and a solid metal crypto backup. In most cases, you just need to store the first 4 letters of the seed words. Why? Check it out in our article about why you only need the first 4 letters of a seed word.

Securing your Bitcoin and cryptocurrency requires careful consideration of your storage options. Embracing self-custody and understanding the critical role of seed phrases are foundational steps in protecting your digital assets. With the right strategies, including the use of cold storage wallets and metal plate backups, you can ensure the safety of your crypto investments for the long haul.

Find out which hardware wallet or metal Cryptotag seed phrase storage you need at cryptotag.io/

With the advent of innovative storage solutions, from hardware wallets to metal plate backups, the tools for protecting digital assets have never been more accessible.

The best hodl stories, OPSEC tips, and weekly updates of the market.

Weekly hodl insights

Weekly hodl insights Bonus content access

Bonus content access Exclusive offers

Exclusive offers